The Double Tweet: The Shock and the Rebound

No one imagined that 280 characters could unleash a shockwave on par with a global recession.

Trump’s first tweet was the trigger — a shot fired across the digital ocean.

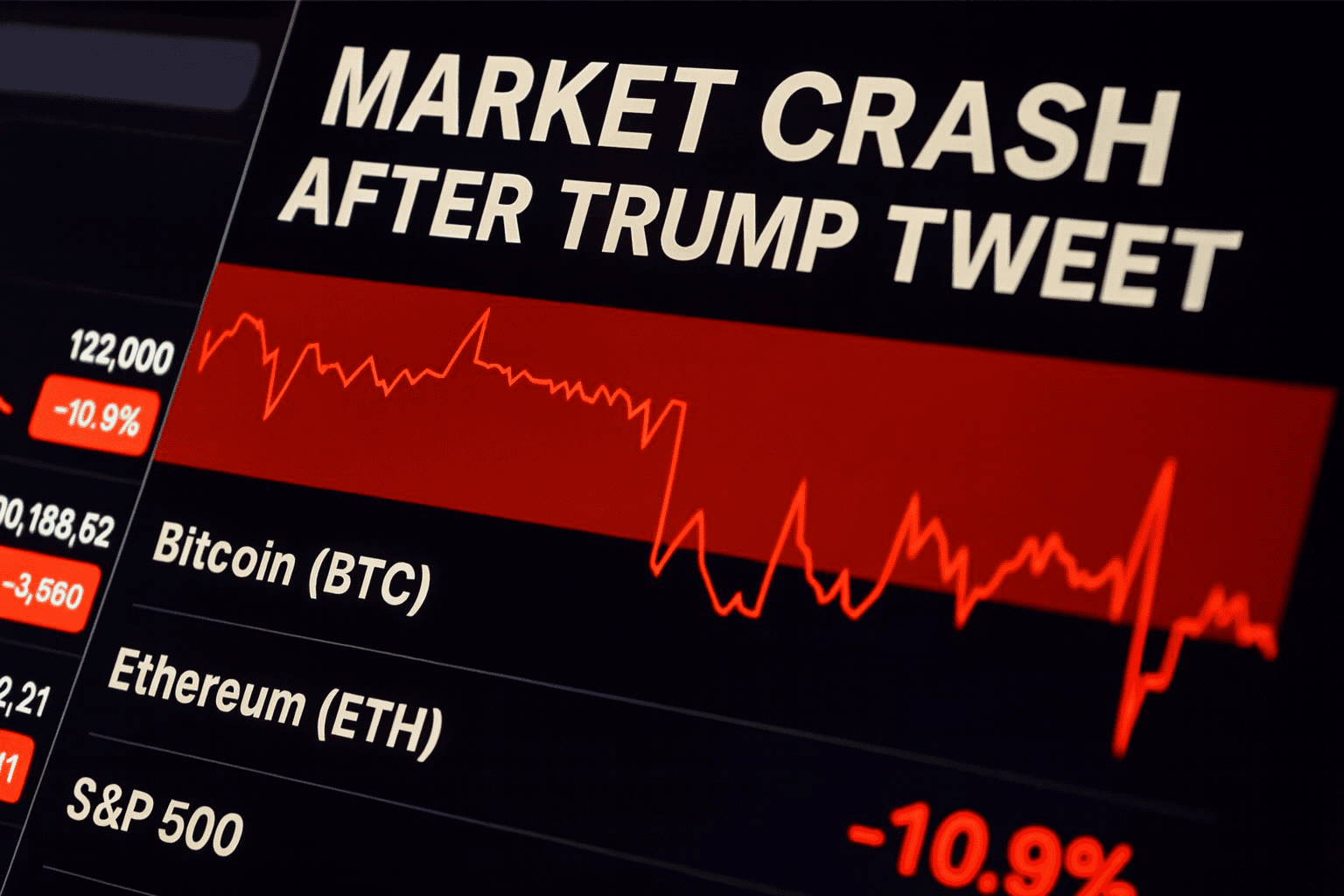

He announced 100% tariffs on Chinese electronics and tech exports, and markets plunged within seconds.

Trading algorithms reacted faster than human thought; crypto bots and hedge funds followed like dominos, collapsing in one direction — down.

The world sank into digital panic. People lost millions in their sleep. Some woke up to zero balances, others to liquidation notices.

Market giants — the so-called “whales” — offloaded assets, sweeping away small investors like driftwood. Then came silence.

And two days later — the second tweet:

“Don’t worry about China, it will all be fine.”

As if someone had said after the explosion: “False alarm. Relax.”

But the economy doesn’t forgive jokes delivered late.

By the time those words appeared, capital had already drained out of funds, exchanges were no longer rebounding but freezing, and people — those same people for whom “it will be fine” — were left with debts and fear.

Why There’s No Answer

The world watches — and stays silent.

Because there is no one left to answer.

The global economy is built around centers of power where every U.S. move, especially one this theatrical, sends tremors across continents.

Europe, weakened by inner contradictions and dependent on American markets and technologies, can only issue statements — not counterblows.

Like ancient Rome drafting senate decrees while the barbarians stood at its gates, Europe keeps debating regulations as the walls of its marketplace crumble.

The European Union has become a hostage to its own humanism — still believing that the world can be governed through norms, treaties, and compromise.

But the 21st century plays by other rules: the rules of speed, cynicism, and real-time influence.

Trump understands this perfectly and wields it like a cynical marketer.

One tweet, one panic — and in the shadow of collapse, someone quietly buys the dip.

Every outburst of anger becomes not just an emotional spasm, but an act of enrichment.

He plays the global economy like a carnival con artist: shouting, pounding the table, throwing the crowd into chaos — and walking away with the winnings. And Europe replies with reports. China is preoccupied with its own crises, Russia with its isolation, Eastern Europe with debt dependency.

And in this silence, Trump can do what once seemed impossible: dictate the tone of the planet without armies, oil, or weapons — only words.

The Cost of Silence

At the peak of the collapse, headlines blurred into numbers — billions lost, percentages erased, charts bleeding red.

But behind every digit there is someone’s sleepless night, someone’s breath caught between hope and ruin.

Markets fall loudly, but people break quietly.

They log out, vanish from chats, stop answering calls — not out of tragedy, but exhaustion. The world doesn’t count them, because pain doesn’t appear in financial reports.

This is the true cost of panic — not in dollars, but in human rhythm.

Anxiety spreads faster than capital; despair compounds faster than interest. And every crash leaves something invisible behind — a silence the market will never price in.

The Dictatorship of Emotion

The 21st century has invented a new form of power — the power over nerves.

If the 20th century was ruled by oil, gold, and nuclear fear, today the world is ruled by emotion.

Investors no longer fear sanctions — they fear moods.

Politicians have learned that a well-timed phrase can crash an economy faster than any bomb.

We now live in a civilization where panic has become the new currency.

Each tweet is a pulse; each reaction, a market price. And while humanity keeps searching for villains, it overlooks the obvious:

we turned language itself into a weapon.

Epilogue

Once, power was measured in money. Now, money is measured in attention.

And while the world debates regulations and interest rates, someone simply types “Don’t worry” — and sets off another global storm.

Words have become the new gold —

but far more dangerous: weightless, yet powerful enough to bring worlds down.