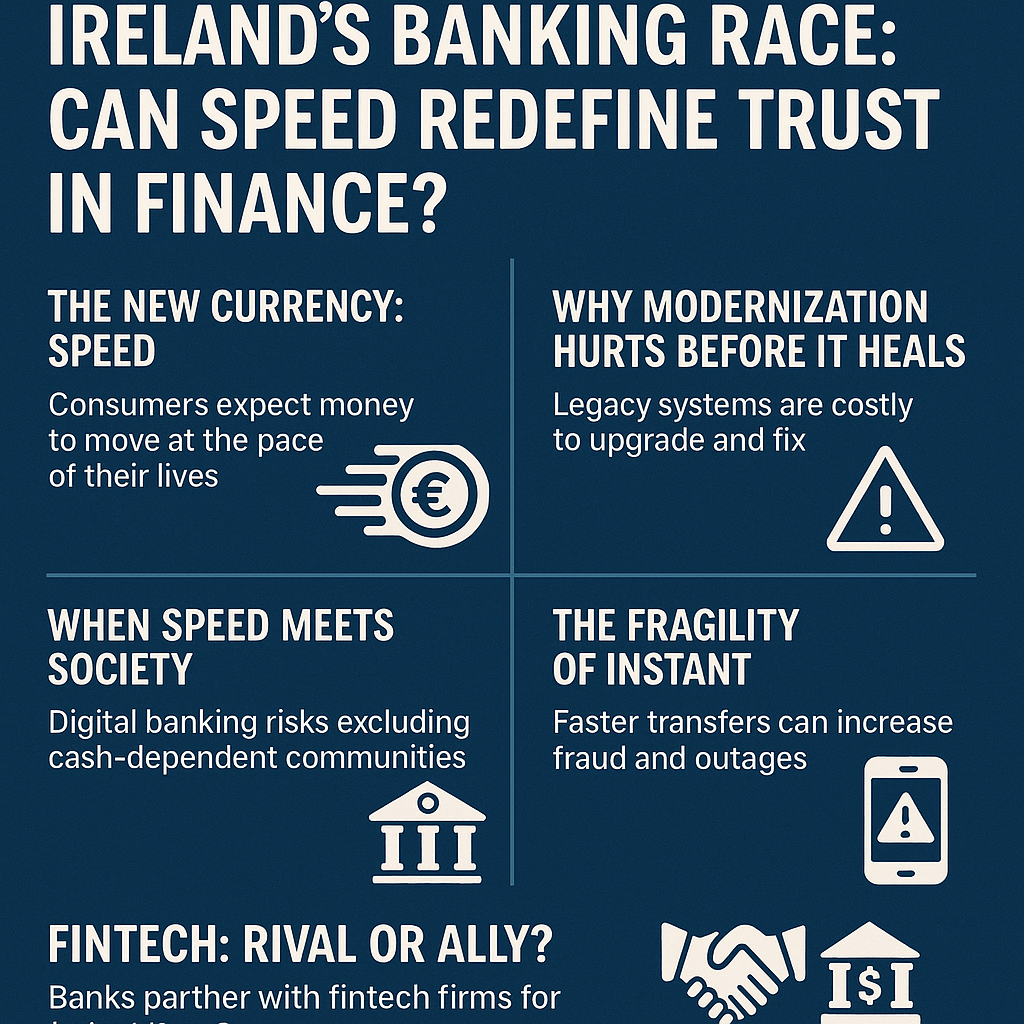

The New Currency: Speed

Speed in finance is no longer a luxury; it is the currency of trust. Same as payout speed is a new currency for online casino, by the way (take a look at instant withdrawal casino). Consumers expect money to move at the pace of their lives.

- For individuals, delays mean anxiety. A parent like Aoife feels her bank is unreliable. A young graduate using Revolut or Wise feels traditional banks are dinosaurs.

- For businesses, delays mean lost opportunities. A supplier waits to be paid before releasing stock; a contractor cannot pay workers until funds arrive. Every hour of delay compounds into friction in the economy.

- For nations, delays mean reputational risk. Countries with sluggish financial infrastructure risk losing out to competitors where funds move fluidly and securely.

The irony is that speed itself is invisible. No one praises a bank for processing a transfer instantly; they simply expect it. But when speed is missing, dissatisfaction spreads like wildfire.

Why Modernization Hurts Before It Heals

Behind every “slow” transaction lies a hidden architecture. Many Irish banks still operate on legacy IT systems built decades ago. These systems were never designed for instant global payments.

Rebuilding them is like replacing the engine of an airplane mid-flight. Costs run into tens or even hundreds of millions of euros. Mistakes can be catastrophic: Britain’s TSB bank discovered this in 2018 when a botched migration left millions locked out of accounts for weeks. The bank’s reputation still hasn’t fully recovered.

For Ireland’s smaller regional banks and credit unions, modernization may be financially impossible. This raises uncomfortable questions: will the future belong only to the biggest banks and global fintechs, while community banks fade into history?

When Speed Meets Society

The push for speed also collides with culture and community.

In rural Ireland, cash still matters. Bank branches are not just service points; they are social anchors. Closing them in favor of sleek digital apps risks alienating older generations and eroding local trust.

For seniors, digital banking often feels like hostile terrain. They fear scams, find apps confusing, and still value the reassurance of a human teller. If speed comes at the cost of accessibility, then banking risks dividing society into digital “haves” and “have-nots.”

The challenge for Irish banks is not just to modernize, but to modernize inclusively — ensuring that the race toward instant transactions does not abandon those who rely on slower, human-centered interactions.

The Fragility of Instant

There is another paradox: the faster systems become, the more fragile they are.

- Fraud grows faster. Criminals exploit instant payments to move money before banks can react. In 2023, Europeans lost billions through scams that thrived in high-speed digital channels.

- Outages spread wider. When a real-time system crashes, it can paralyze thousands of transactions in minutes. The more people rely on instant transfers, the more devastating a technical hiccup becomes.

- Reputation collapses quicker. Trust in finance takes decades to build and seconds to lose. One high-profile failure could spark an exodus of customers to fintech rivals.

Thus, banks must run a double race: speeding up while simultaneously building deeper resilience in cybersecurity, redundancy, and fraud detection.

Fintech: Rival or Ally?

Fintech companies have already redefined what “fast” looks like. Revolut, N26, Wise — for many young Irish consumers, these are the brands that embody agility.

But increasingly, banks are choosing partnership over rivalry.

- At home, Bank of Ireland and AIB have integrated fintech services to streamline international transfers and digital payments.

- Across Europe, traditional banks are adopting fintech innovations: biometric identity checks, AI-driven fraud monitoring, and open banking APIs.

These alliances create a hybrid ecosystem: banks provide scale, licenses, and customer trust, while fintechs inject speed and creativity. Together, they can move faster than either could alone.

The Human Side of Speed

For soldiers returning from UN peacekeeping missions, for farmers selling produce across borders, for students studying abroad — speed in finance is not abstract. It is personal. It means paying rent on time, getting wages without delay, or sending help home instantly.

This is why the debate about banking speed is really a debate about dignity and trust. People want to feel that their money moves at the same pace as their lives.

Ireland’s Choice

Ireland now stands at a crossroads. It can either embrace financial modernization — with all its risks, costs, and cultural tensions — or risk falling behind as fintechs and foreign banks win over its citizens.

The race for speed is not about milliseconds; it is about balance:

- between innovation and inclusion,

- between speed and security,

- between tradition and transformation.

The banks that strike this balance will not just survive; they will redefine what it means to trust a financial institution in the 21st century.

For Ireland, the clock is already ticking.